Mercedes-Benz Sprinter 170" wheel base Cargo Van !!!!!THIS IS INSANE!!!!!!

- Condition: New

- Make: Mercedes-Benz

- Model: Sprinter

- Trim: Cargo Van

- Year: 2016

- Mileage: 279

- VIN: WD3PE8DD7GP177393

- Color: White

- Engine size: 2.1 4 Cyl Turbo Diesel TOP NOTCH QUALITY

- Number of cylinders: 4

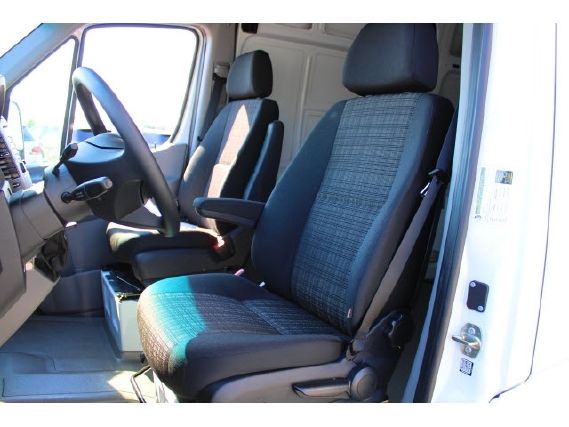

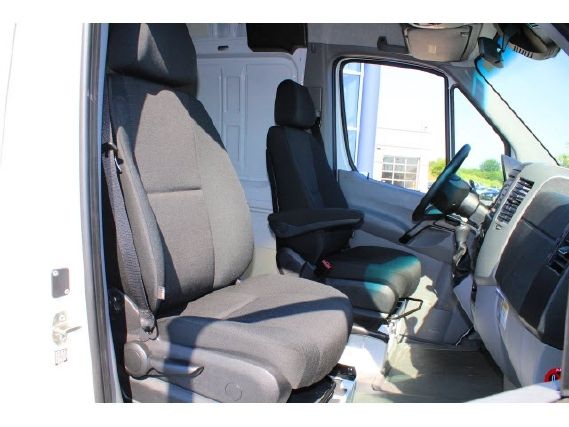

- Power options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

- Fuel: Diesel

- Transmission: Automatic

- Drive type: RWD

- Interior color: Black/Gray

- Safety options: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

- Options: C04 package, Park Distance Control, Lane Keep Assist, Blind Spot Assist

- Vehicle Title: Clear

- Interested?

2016 Mercedes-Benz Sprinter Cargo Van Description

Look, I wont waste your time on explaining this van. If you are looking for a Sprinter you know what you are looking for. If you have questions call me. I will be happy to help you find the right Van for your business needs and help move your business to the next level.

Follow this link to get all the vehicle specific information on this van

http://www.autoipacket.com/packet-share/?p=WD3PE8DD7GP177393&CFID=50394643&CFTOKEN=58427553

Now... Lets Talk about how to SAVE BIG$$$ in business taxes in 2016

You can write off up to $25,000 on the purchase of a new work vehicle and also recieve up to $8,000 in additional tax write offs

A Primer for Commercial Vehicle Tax Deductions

What You Need to Know about Buying or Leasing a New Business Vehicle as a Tax Deduction

Running your own business can be an incredibly rewarding endeavor, and having the right tools for the job can be very costly. Maybe you, like many business owners in Kansas City think that getting a new vehicle specifically for your business could be very helpful and help your operations to be more effective and efficient, but perhaps you have reservations about whether or not you canreallyafford one at this juncture in time.

What you may not know, however, is that when you purchase a commercial vehicle like theMercedes-Benz Sprinter Van or the all new Mercedes-Benz Metris for the use of your business, you write it off as a tax deduction.

Interested in learning more?

Take a look at our brief outline of how the tax deduction process works, which vehicles qualify, what the restrictions are, and more. Then, when you're ready, visit us here atwww.mb-kc.comto peruse your options.

Q: What is the Section 179 Deduction?

A:Section 179 of the IRS tax code allows businesses to deduct the purchase price of qualifying equipment purchased or financed during the tax year. That means, if you buy or lease a qualifying piece of equipment, such as a Sprinter Van--you can deduct the purchase price from your gross income. The result is tax relief for small businesses inKansas City, and all across the country.

Q: What vehicles qualify?

A:Automobiles with a GVWR of over 6000 lbs will apply

Keep in mind that the vehicle must be "new to you"--so you can buy or lease a new Sprinter, or purchase a used one.

Q: What are some of the restrictions?

A:There are several restrictions such as the following:

- As previously mentioned, the vehicle must be "new to you."

- In order to qualify, the vehicle must be used for business at least 50% of the time.

- You may only make a claim in the tax year that the vehicle is "placed in service"--meaning, when it is ready to use, regardless of whether or not you are actually using it.

- There are caps to the total amount written off of $500,000 and a $2,000,000 limit to the total amount of the equipment purchased.

Please keep in mind that this article is written for reference only. Before making any purchasing decisions based on tax code we suggest you speak with your tax specialist first

|

2011 Mercedes-Benz Sprinter High Top Long Wheel base Extended Cargo Van

2011 Mercedes-Benz Sprinter High Top Long Wheel base Extended Cargo Van

Mileage: 316,108

2006 Mercedes Benz Sprinter 2500 Diesel, White, Racks, Cargo, Short Wheel Base

2006 Mercedes Benz Sprinter 2500 Diesel, White, Racks, Cargo, Short Wheel Base

Mileage: 219,071

2014 MERCEDES SPRINTER CARGO WORK VAN SHELVES HI TOP SHORT WHEEL BASE

2014 MERCEDES SPRINTER CARGO WORK VAN SHELVES HI TOP SHORT WHEEL BASE

Mileage: 47,375

2012 Mercedes-Benz Sprinter Base Standard Cargo Van 4-Door 2.1L

2012 Mercedes-Benz Sprinter Base Standard Cargo Van 4-Door 2.1L

Mileage: 166,551

2012 Mercedes-Benz Sprinter 2500 Base Standard Cargo Van 3-Door 3.0L

2012 Mercedes-Benz Sprinter 2500 Base Standard Cargo Van 3-Door 3.0L

Mileage: 71,200

2011 Mercedes-Benz Sprinter 2500 Base Standard Cargo Van 3-Door 3.0L

2011 Mercedes-Benz Sprinter 2500 Base Standard Cargo Van 3-Door 3.0L

Mileage: 37,600

2013 Mercedes-Benz Sprinter 3500 Base Standard Cargo Van 3-Door 3.0L

2013 Mercedes-Benz Sprinter 3500 Base Standard Cargo Van 3-Door 3.0L

Mileage: 61,300

2010 Mercedes-Benz Sprinter 2500 Base Standard Cargo Van 3-Door 3.0L

2010 Mercedes-Benz Sprinter 2500 Base Standard Cargo Van 3-Door 3.0L

Mileage: 204,000

2013 Mercedes-Benz Sprinter 2500 Base Standard Cargo Van 3-Door 3.0L

2013 Mercedes-Benz Sprinter 2500 Base Standard Cargo Van 3-Door 3.0L

Mileage: 36,019

NO RESERVE 2013 Mercedes Benz Sprinter 2500 170' Wheel Base Super High Top

NO RESERVE 2013 Mercedes Benz Sprinter 2500 170' Wheel Base Super High Top